We are an open company building the sustainable financial ecosystem of the future

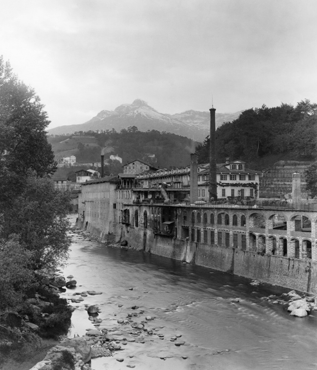

There are so many ways to tell you who we are. Describing to you our approach to the future is one of them. That is also because our way of heading into tomorrow is deeply rooted in our over 450 years of entrepreneurial history - we listen to questions and try to turn them into answers.

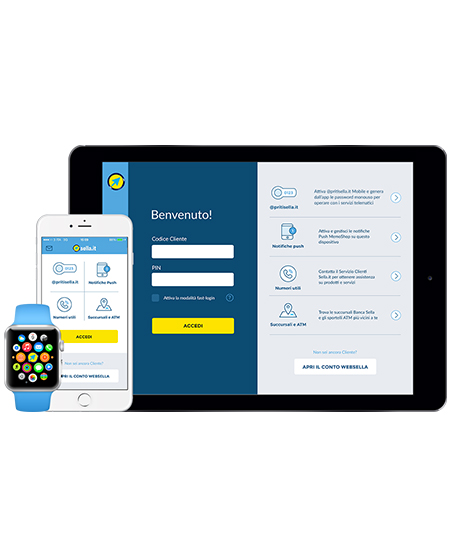

Today we are the largest private and independent banking group in Italy. We have over 5,000 employees, we are present in 7 countries and have 300 branches throughout Italy. Our activities include commercial and retail banking, private banking and wealth management, corporate and investment banking, payment systems, open banking and information technology services.

We foster, operate and are an open innovation ecosystem committed to sustainable growth. We give support to the ideas and entrepreneurship of startups and businesses through our Sellalab Innovation Centre. We have founded and stimulate the Italian fintech community - the Fintech District of Milan. We have launched the first open banking platform in our country. We do all this by putting the interests of our customers before our own, aware that in a medium and long-term perspective, these interests coincide.

Values

450 years of business and innovation at the service of our customers

Banca Sella Holding S.p.A.

Banca Sella Holding concentrates a wide variety of functions in a single entity. In its capacity of Parent Company of the Sella Group it carries out the activities of management, coordination and control, identifying the strategic guidelines for the development of the Group. These activities, according to the rules and regulations of the sector and to those set out by company laws, provide for the functioning of the Banking Group by a "sound and prudent management" and for a strategic control on the development of the different areas of activity in which the Group operates and on the risks related to the activities carried out.

Banca Sella Holding also carries out activities of the financial sector (proprietary trading, management of centralised treasury activities, of its own securities portfolio and corporate finance activities).

Other centralised activities carried out in the interest of the Group are the trading of financial instruments, access to financial markets and local transfer agent services.