Le prime tracce dell'attività imprenditoriale della famiglia Sella risalgono alla seconda metà del Cinquecento, quando Bartolomeo Sella e suo figlio Comino operano come imprenditori tessili nella Valle di Mosso, nel biellese.

Col passare del tempo all'attività tessile si aggiunge l'azienda agricola, dalla metà del Seicento, e la banca, dalla metà dell'800. Tre settori in cui ancora oggi la famiglia è attiva.

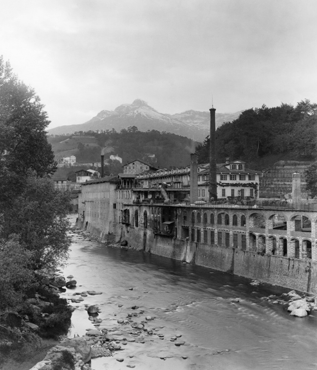

Lungo questa storia la propensione all'innovazione e alle nuove tecnologie ha sempre rappresentato una costante. Nel corso dell'Ottocento i Sella sono protagonisti dei primi passi dell'industrializzazione nel campo tessile. Dopo un viaggio in Inghilterra, infatti, Pietro Sella acquista otto esemplari diversi di macchine per la filatura che, una volta in funzione, contribuiscono all'avvio della rivoluzione industriale italiana e alla crescita dell'azienda di famiglia.

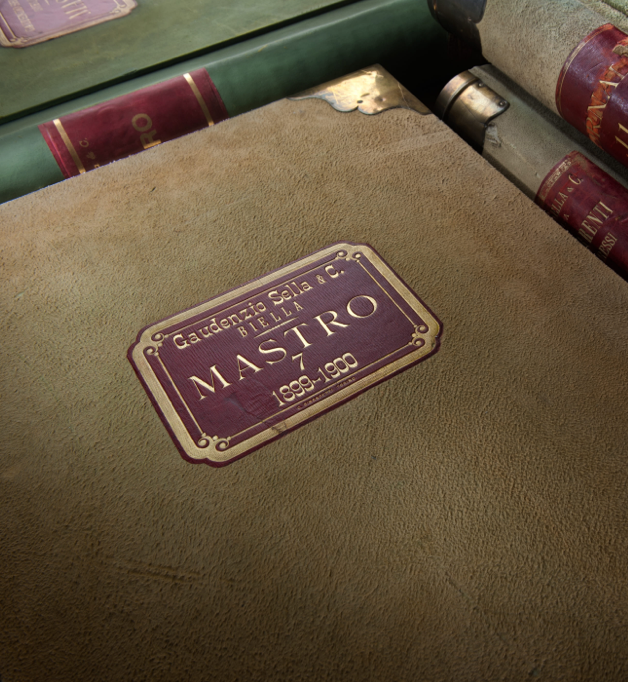

Con il settore tessile ben avviato, è Quintino Sella a ispirare l'idea di dar vita a una banca, che nascerà dopo la sua morte. Il 23 agosto 1886, infatti, il giovane ingegnere Gaudenzio Sella fonda con sei fratelli e cugini la società in accomandita Gaudenzio Sella & C., che è all'origine dell'attuale Gruppo. Tra i soggetti fondatori c'è anche il lanificio Maurizio Sella, che sottoscrive una quota significativa del capitale sociale.

L'antico lanificio oggi è sede delle attività informatiche e tecnologico del Gruppo, della piattaforma di innovazione Sellalab, dell'Università aziendale e della Fondazione Sella, che conserva la memoria della famiglia.

Nel corso del Novecento, mantenendo sempre saldo il legame con il territorio d'origine, la banca si trasforma in società per azioni e assume la denominazione di Banca Sella, intraprendendo un processo di graduale e costante crescita e uscendo dalla dimensione di banca locale, anche attraverso l'acquisizione di altri istituti presenti sul territorio nazionale.

Nel 1992 viene costituito il Gruppo Sella, una realtà ampia e articolata le cui attività oggi comprendono la banca commerciale e retail, i servizi di private e wealth management, il corporate & investment banking, i sistemi di pagamento, l'open banking e i servizi di information technology.

Con spirito pioneristico la banca e il Gruppo hanno sempre fatto da apripista in vari settori: l'introduzione delle macchine Chubb, antenate dei moderni sportelli automatici per prelevare denaro contate, i Buoni Ordinari del Tesoro nell'offerta di gestione del risparmio, la prima compravendita azionaria inviata al mercato italiano via internet, le prime transazioni di e-commerce a livello europeo, l'internet, il mobile e il voice banking.

Nel 2013, anticipando il nuovo paradigma del Fintech e dell'open innovation, nel Gruppo viene creato il centro d'innovazione per startup e imprese Sellalab, in cui nasce anche la challenger bank Hype.

Il Gruppo, inoltre, promuove la nascita del Fintech District di Milano e la prima piattaforma italiana di open banking Fabrick, dando vita così a un ecosistema innovativo e aperto, che continua a crescere.